Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

Waiting for higher interest rates? It could cost you!

You already know that the interest rate your money earns plays a big role in how much you accumulate, but did you know that when you start earning interest may be just as important?

What can waiting cost you in the long run?

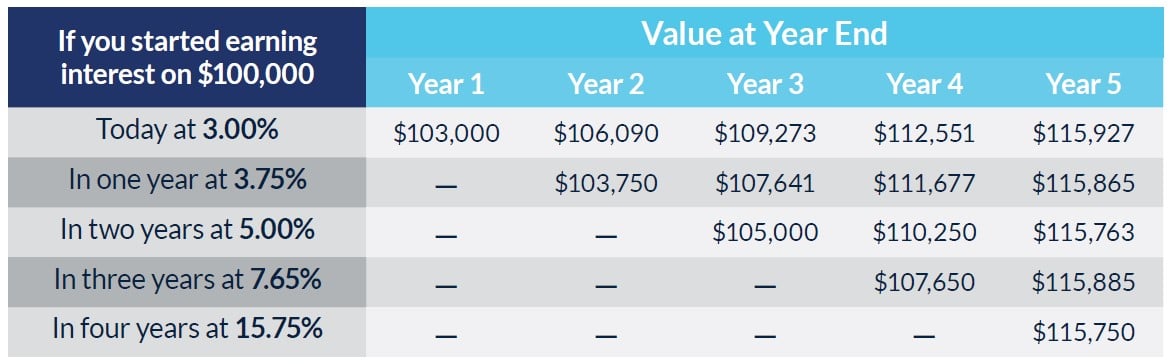

The following example shows how waiting just one or two years can have a big impact on the interest rate your money would need to earn to make up for lost time.

You can see that starting to earn 3.00% today will increase $100,000 by approximately the same amount as waiting to invest $100,000 at 3.75% a year from now or at 15.75% four years from now. Buying an annuity at current rates could be more beneficial than waiting to see if rates increase.

Contact your financial professional to learn more.

This information is not intended or written to be used as legal or tax advice. You should seek advice on legal and tax questions from an independent attorney or tax advisor. Guarantees included in annuity products issued by MassMutual Ascend Life Insurance Company are based on its claims-paying ability.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of MassMutual under contract form numbers P1074514ID, P1138919ID, P1088011ID, P1088111ID, P1463016ID, P1459716ID, P1123117ID, P1123217ID, P1470017ID, P1470218ID, P1135619ID, ICC21-P1152021NW, P1113516ID, P1126818ID, ICC21-P1152121NW, P1080010ID, P1471718ID, ICC21-P1476721NW, P1133518ID, ICC21-P1152221NW, ICC21-P151621NW, P1140119ID, P1146620ID, P1140219ID, P1110416ID, ICC20-P1144420NW, ICC20-P1144520NW, ICC20-P1474420NW, P1020212ID, P1086811ID, P1081610ID, P1134618ID, P1112916ID, ICC21-P1151521NW. Products not available in all states. Form numbers and features may vary by state.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6083324NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.