How money earns interest in a fixed-indexed annuity

When you envision a future that fulfills you, maybe you see yourself traveling, cooking, spending time with family or discovering a new hobby. Whatever it is, our goal is to help you navigate your future with confidence. Consider how a fixed-indexed annuity could help take your financial future above and beyond.

Fixed-indexed annuities offer multiple interest strategies to help you build your savings. These can include declared rate strategies and indexed strategies.

Declared rate strategy

Funds in a declared rate strategy earn interest at a fixed rate that is set at the start of each term. Interest is credited daily.

Indexed strategies

Funds in an indexed strategy earn interest that is based, in part, on the positive performance of an external index or an exchange traded fund (ETF) over a term. If index or ETF performance is negative, the interest strategy earns no interest. Interest is credited annually at the end of each term.

Interest is limited by either a cap or participation rate.

- A cap is the maximum interest rate that can be credited for a term year.

- A participation rate is the percentage of a positive index change that will be credited for a term year.

It's important to note that not all strategies are available on all products, and may not be available in all states. Caps and participation rates may vary from term to term and among indexed strategies and products.

You have the flexibility to choose the strategies that are right for you. We know your needs may change over time, so you can revisit your strategy selections at the end of each term.

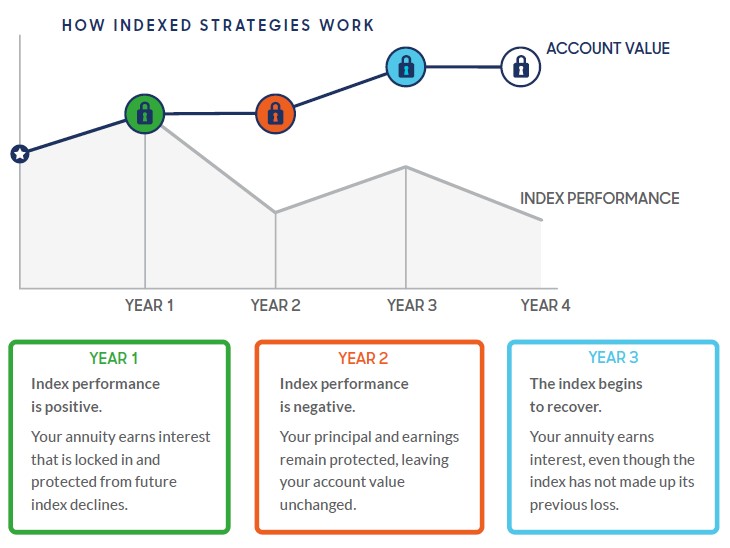

Indexed strategies in action

Not only do indexed strategies provide the opportunity to earn interest based on market growth, but they keep your money protected in the event of market declines.

When index performance is positive, interest is credited to your annuity and it's locked in. This means your annuity cannot lose value due to future market performance.

On the other hand, if index performance is negative, you won't lose money. But, you can still earn interest during future terms. Let's take a look at how it works.

The example above is for illustrative purposes only. It does not reflect actual index performance.

Point-to-point indexed strategy

One type of indexed strategy we offer is called a point-to-point. A point-to-point strategy compares index values from two points in time: the closing value at the end of a term year to the closing value on the first day of a term year. If the result is positive, interest is credited, subject to the cap or participation rate. If the result is negative, the credited interest rate is 0%.

Example

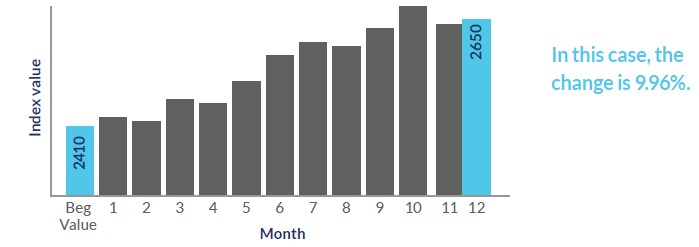

1. Calculate the index change

Subtract the beginning index value (2410) from the ending value (2650) and calculate the percentage of change (240÷2410).

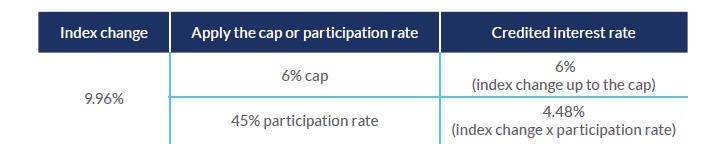

2. Determine the credited interest rate

Take the index change and apply the cap or participation rate. We'll use a hypothetical 6% cap and a 45% participation rate.

Under this hypothetical example, the credited interest rate for the term year would be 6% if the strategy uses a cap or 4.48% if the strategy uses a participation rate.

When you're ready to start receiving money from your annuity, you can rest assured knowing that you have the option to elect income payments that will last the rest of your life.

To learn more about fixed-indexed annuities and if they are right for you, check out our "Is a fixed-indexed annuity right for me?" brochure!

For advice tailored to your specific circumstances, contact your financial professional.

For use with contract forms P1074514NW, P1074514ID P1470017NW, P1470017ID, P1470218NW, P1470218ID, ICC21-P1152021NW, ICC21-P1152021NW, ICC21-P1152121NW, ICC21-P1152121NW, ICC21-P1476721NW, ICC21-P1476721NW, P1140119NW, P1140119ID, P1140219NW, P1140219ID, P1146620NW, P1146620ID, P1110416NW, P1110416ID, ICC20-P1144420NW, ICC20-P1144420NW, ICC20-P1144420NW-NoMVA, ICC20-P1144420NW-NoMVA, ICC20-P1144520NW, ICC20-P1144520NW, ICC20-P1144520NW-NoMVA, ICC20-P1144520NW-NoMVA, ICC20-P1474420NW, ICC20-P1474420NW, ICC20-P1474420NW-NoMVA, ICC20-P1474420NW-NoMVA, P1134618NW, P1134618ID, P1134618NW, P1134618ID-NoMVA P1112916NW, P1112916ID, P1129918NW, P1129918ID, P1129918NW, and P1129918ID-NoMVA. Form numbers vary by state.

Products, riders and features may vary by state, and may not be available in all states. See specific product disclosure documents for details.

Products are issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

All guarantees subject to the claims-paying ability of the issuing company.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F1173124NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.