Could rising interest rates derail your future plans?

After more than a decade of impressive stock market growth, recent volatility may have you looking for ways to protect your earnings.

Traditionally, fixed-income investments are used to bring safety and stability to a financial portfolio. But, with interest rates on the rise, these investments come with risk, too.

As interest rates go up, bond fund values generally go down. This could mean trouble if you are counting on bond investments for reliable retirement income.

The hidden risk of rising rates

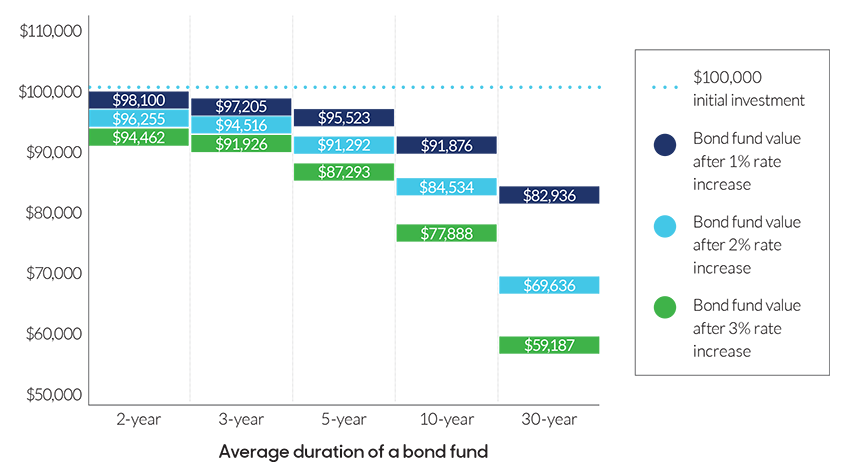

Consider how the value of a $100,000 investment in a bond fund can be affected by a one-time interest rate increase.

Don’t let increasing interest rates derail your retirement plans. Fixed-indexed annuities provide principal protection and growth opportunity that can help avoid some of the negative side effects of rising rates.

For advice tailored to your specific circumstances, contact your financial professional.

MassMutual AscendSM is not an investment adviser and the information provided in this document is not investment advice. You should consult your investment professional for advice based on your personal circumstances and financial situation.

Duration is a measurement of a bond fund’s sensitivity to interest rate fluctuations. It is not the same as the bond fund’s average time to maturity or average term.

Example assumes starting interest rates of 2.52% for 2-year duration bond fund, 2.64% for 3-year, 2.80% for 5-year, 2.97% for 10-year and 3.11% for 30-year.

ICC24-P1850824NW, ICC24-P1841724NW, ICC24-P1841624NW. Form numbers vary by state.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F1173625NW

Have questions?

Speak with an annuity expert for no pressure, thoughtful insight to help plan a perfectly protected retirement.