Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

Simplifying Social Security

A guide for understanding your options and making the most of your benefits

If you’re like millions of Americans, you’ve spent your working years contributing to Social Security. As these years come to an end and you prepare to retire, you’ll probably begin to think about how Social Security will fit into your income plan.

There are a number of factors that should be taken into consideration when filing for Social Security – each of which plays a critical role in the benefits you’ll receive during your years in retirement.

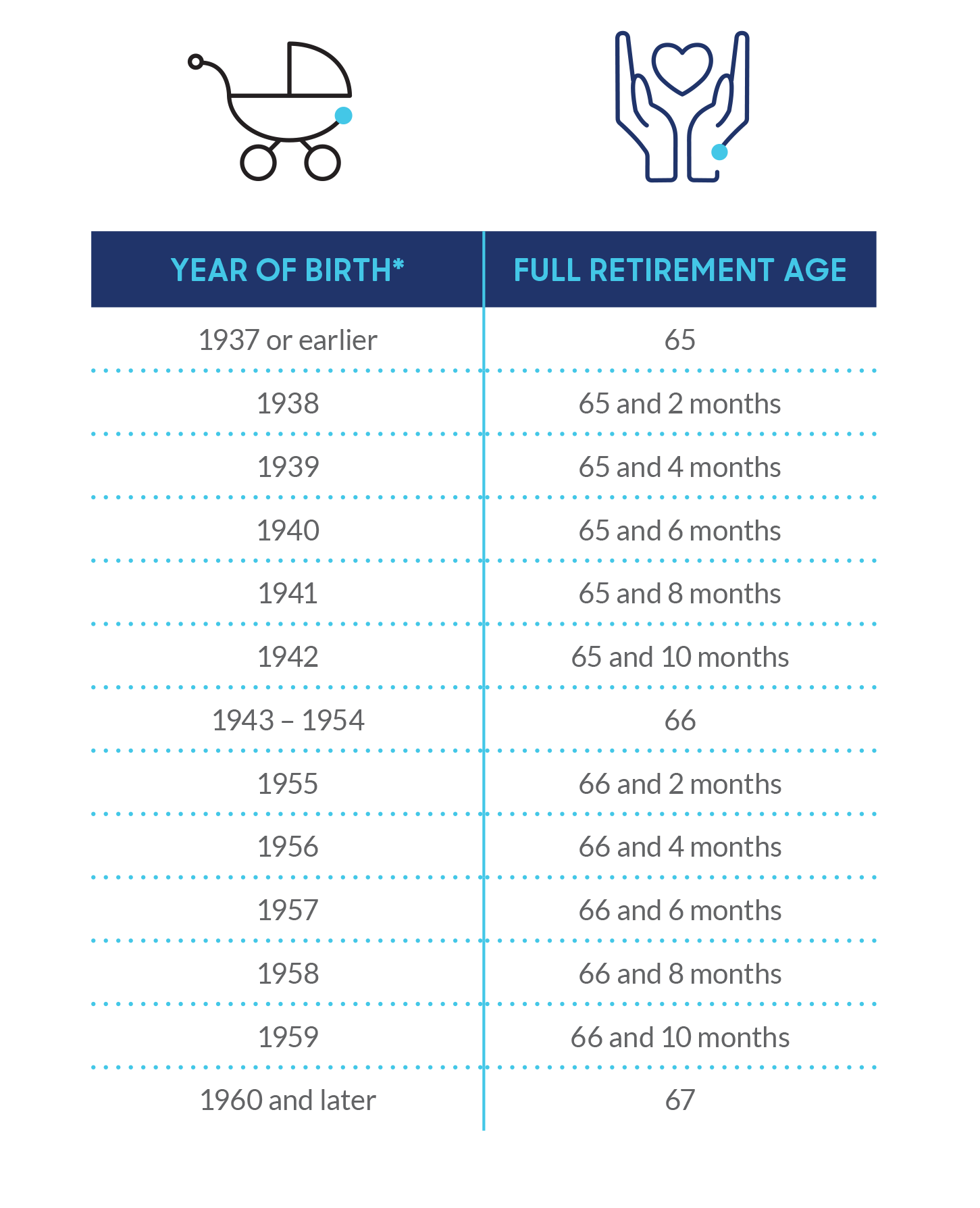

Understanding full retirement age

Your full retirement age is the age at which you qualify for 100% of your Social Security benefits and is based on your birth year.

*If you were born on January 1st of any year you should refer to the previous year. If you were born on the 1st of the month, the Social security Administration figures your benefit – and your full retirement age – as if your birthday was in the previous month. Source: SocialSecurity.gov, “Retirement Benefits”, 2019

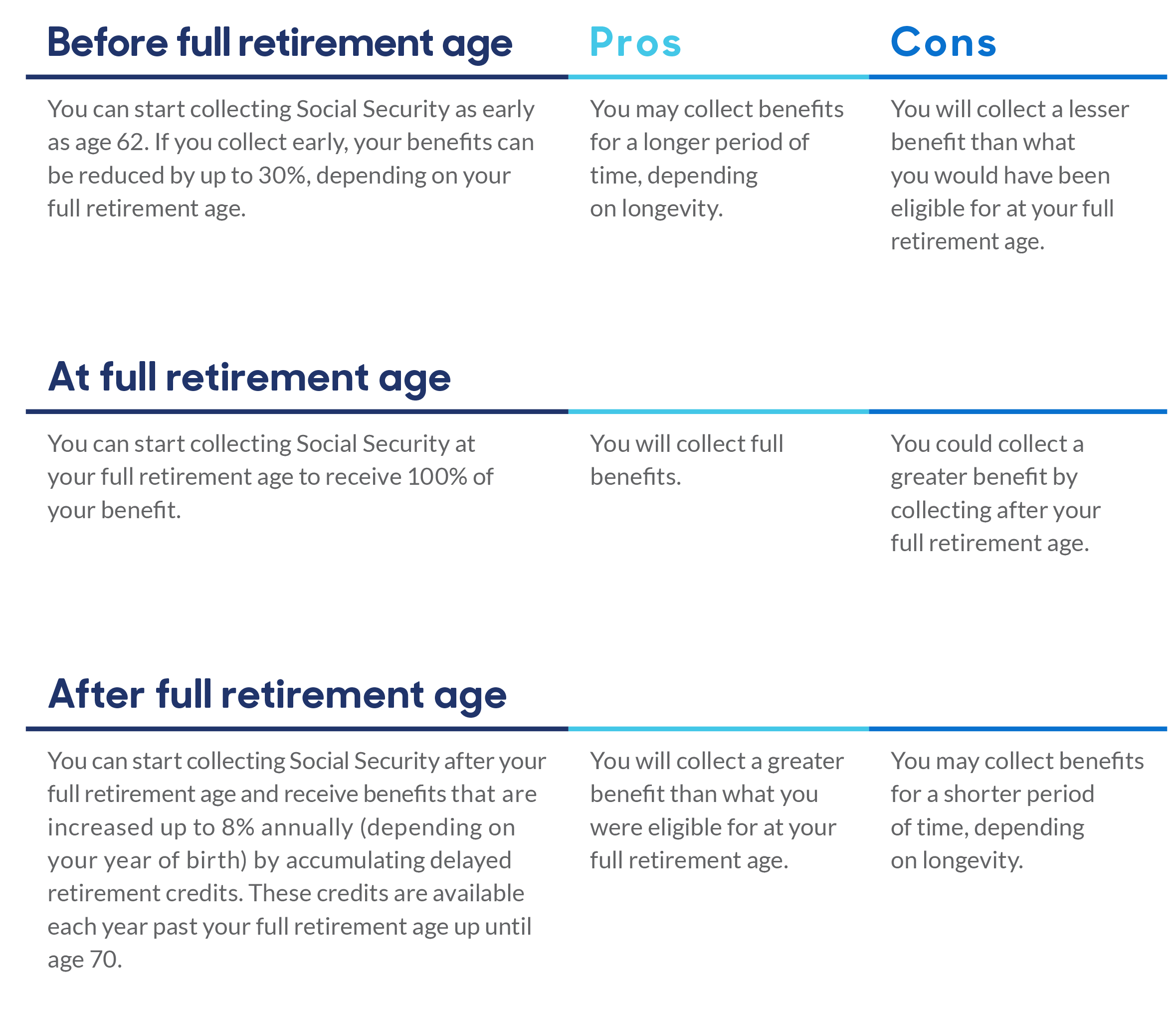

Deciding when to collect

While you qualify for 100% of your Social Security benefits at your full retirement age, you have the option to start collecting benefits either before or after your full retirement age. There are pros and cons to all options.

Sources: https://www.ssa.gov/benefits/retirement/planner/agereduction.html

https://www.ssa.gov/benefits/retirement/planner/delayret.html

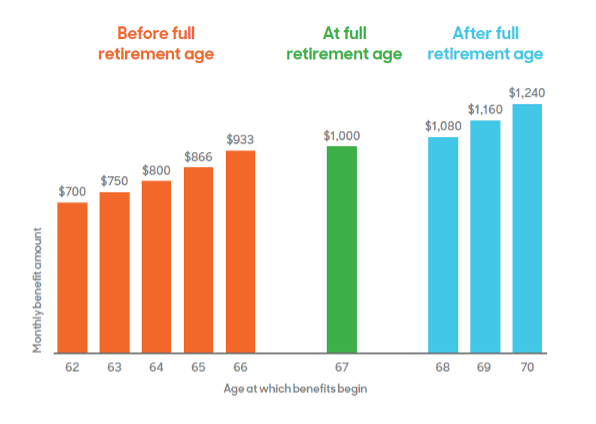

Hypothetical example

The graph below illustrates how collecting Social Security before and after full retirement age can impact monthly benefits. It assumes a monthly benefit of $1,000 at a full retirement age of 67.

Source: SocialSecurity.gov, “When to Start Receiving Retirement Benefits,” 2022.

Source: SocialSecurity.gov, “When to Start Receiving Retirement Benefits,” 2022.

Considering the effects of longevity

With the average life expectancy being 84.1 for today’s 65-year-old male and 86.8 for today’s 65-year-old female, longevity is among the most important considerations in deciding when to start collecting Social Security. The longer your life expectancy, the more advantageous it may be to delay collecting benefits.

Source: https://www.ssa.gov/OACT/population/longevity.html (calculated on 8/22/2022).

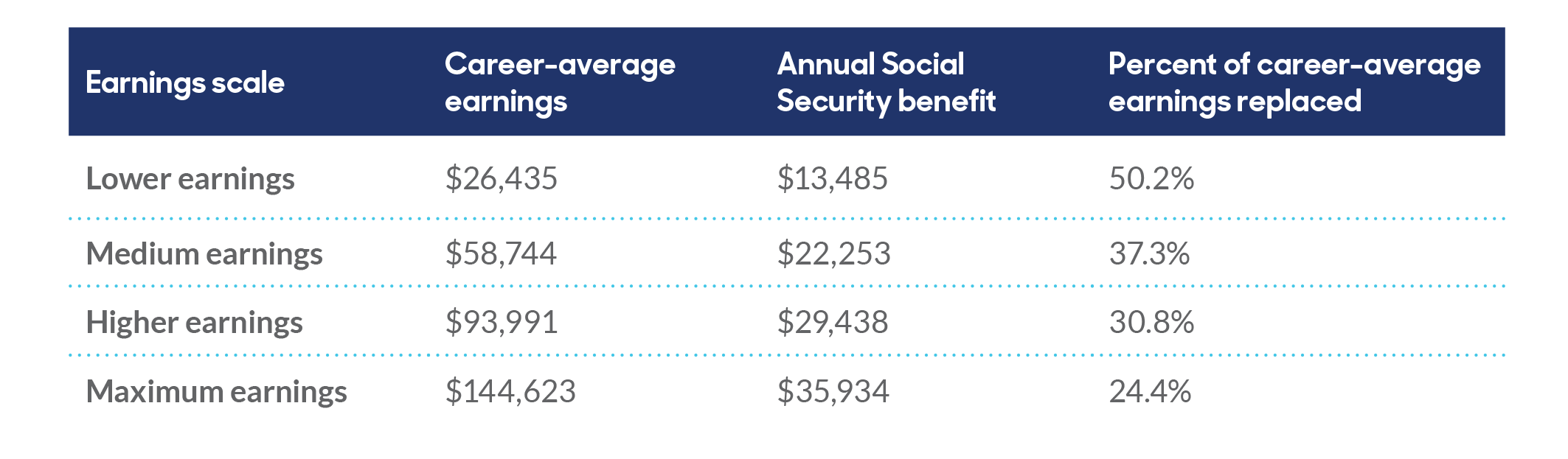

Facing a possible income gap

Social Security was created to promote the economic security of America’s workers. However, it’s important to understand that Social Security will only replace a portion of your pre-retirement earnings, leaving you with a potential income gap.

The amount of income that Social Security will replace depends heavily on your career income. The table below shows how Social Security replaces a greater percentage of income for modest earners versus higher earners.

Table assumes current-law scheduled benefits, and that hypothetical retirees turn 65 in 2023 and begin collecting benefits at age 65. Source: https://www.ssa.gov/OACT/NOTES/ran9/an2022-9.pdf

Adding an annuity to fill the income gap

As you consider these various factors, you may find yourself wondering if your sources of income will last the rest of your life. If this is the case, an annuity may be an appropriate addition to your lineup of income vehicles. An annuity is a contract between you and an insurance company and is designed to protect and grow your money before providing a guaranteed stream of lifetime income. Income from annuities is exempt from the Social Security earnings test which can reduce Social Security benefits prior to full retirement age.

There are many different types of annuities to fit your unique goals for retirement. Some key benefits include:

- Principal protection to help keep your assets safe

- Growth potential to help you accumulate assets

- Tax-deferral for faster accumulation than taxable products

- Guaranteed lifetime income to help ensure peace of mind

Talk with your financial professional about how an annuity could fit into your retirement plan.

MassMutual AscendSM is not an investment advisor and the information provided in this document is not investment advice. You should consult your investment professional for advice based on your personal circumstances and financial situation.

This information is not intended or written to be used as legal or tax advice. You should seek advice on legal and tax questions based on your particular circumstances from an independent attorney or tax advisor.

All guarantees subject to the claims-paying ability of MassMutual Ascend Life Insurance Company.

Products are issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual). For use with contract forms P1020203NW, P1020212ID, ICC25-P1174525NW, P1138919NW, P1138919ID, ICC24-P1172524NW, P1088011NW, P1088011ID, P1088111NW, P1088111ID, ICC22-P1165322NW, P1123117NW, P1123117ID, P1123217NW, P1123217ID, ICC21-P1152221NW, ICC24-P1172024NW, ICC21-P1151521NW, P1086811NW, P1086811ID, P1081610NW, P1081610ID, ICC21-P1151621NW, P1074514NW, P1074514ID, P1470017NW, P1470017ID, ICC21-P1152021NW, ICC21-P1152121NW, ICC21-P1476721NW, P1140119NW, P1140119ID, P1140219NW, P1140219ID, P1146620NW, P1146620ID, P1110416NW, P1110416ID, ICC20-P1144420NW and ICC20-P1144420NW-NoMVA, ICC20-P1144520NW and ICC20-P1144520NW-NoMVA, ICC20-P1474420NW and ICC20-P1474420NW-NoMVA, P1134618NW, P1134618ID and P1134618ID-NoMVA, P1112916NW, P1112916ID, P1129918NW, P1129918ID and P1129918ID-NoMVA, ICC24-P1825224NW, ICC24-P1833624NW, ICC24-P1850824NW, P1841722NW, P1841722NW and ICC24-P1841624NW. Form numbers vary by state.

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation – Not FDIC or NCUA-Insured – Not insured by any federal government agency – May lose value – Not guaranteed by any bank or credit union

F6086125NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.