Insights

When it comes to planning for a secure financial future, there are a lot of factors to consider – like market volatility, interest rates and social security, to name a few. Explore our insights library for information and resources that can help.

Filter by topic

Beyond Annuities: Market risks to consider as you plan for your financial future

From MassMutual Ascend Life Insurance Company

At MassMutual Ascend Life Insurance Company, we understand the importance of a secure financial future. That's why we don't just offer products to help you reach your goals - we also provide educational tools and resources that can help you prepare for and overcome possible obstacles you may face as you plan ahead.

We're looking beyond annuities to help you secure your financial future.

Volatility

Early 2020 marked the end of the longest-running bull market in modern history. Since then, the market has navigated in and out of bear market territory. This kind of volatility can wipe out years of accumulated assets and derail your plans.

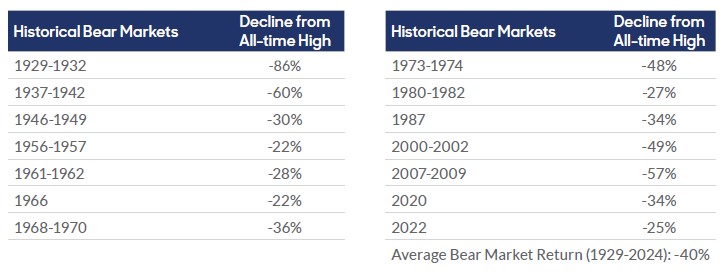

The table below shows historical bear markets since 1929 - with the average bear market return being -40%1.

Plus, it can take a significant return to recover from loss - and if you're nearing retirement, you might not have the time to wait for a major market rebound.

1J.P. Morgan Asset Management, Guide to the Markets - U.S., Data as of December 31, 2024.

Black Swan Events

The term Black Swan Event refers to a rare, unpredictable event or occurrence with widespread consequences and catastrophic effects on the economy. The Dot-Com Bubble Burst, the Global Financial Crisis and the COVID-19 Pandemic are Black Swan Events you may recall over the last two decades.

It might be easy to think, "a Black Swan Event won't affect my financial plan" - but take a look at the impact each of these Black Swan Events had on the market:

To demonstrate the correlation between stock market volatility and Black Swan Events, historical S&P (SPX) values are shown in the graph above. The connecting lines between the points represent high and low index values. The last shown value is as of 12/31/2020. Index values fluctuate over time.

Inflation

It's no secret that inflation is among today's most pressing financial issues. In fact, inflation causes a great deal of concern for 55% of Americans1, with nearly one-third of retirees reporting that their basic living expenses are more costly than expected2.

1Gallup, 2024.

22023 Retirement Investors: Behaviors, Attitudes, and Financial Situations, LIMRA, 2024.

Sequence of Returns

The order or sequence of returns on your portfolio is an important factor to consider in retirement. While the sequence does not have an impact during the accumulation phase, a poor sequence of returns can have a major impact on how long your money will last once you start drawing income from your portfolio. If your retirement coincides with a bear market, your savings could be depleted, leaving you short on income.

Take a look at how a $500,000 portfolio fares during the accumulation and income phases when it experiences early positive returns vs. early negative returns:

Source: Secure Retirement Institute, 2021. The analysis is based on actual S&P 500 index annual return from 2001-2020 (20-year period). The impact of sequence of return in retirement assumes an initial withdrawal rate of 5 percent, adjusted by 3 percent inflation during retirement. The hypothetical portfolio, 'Positive returns early' reflects the actual S&P performance in both charts. The portfolio, 'Negative returns early' based on the same performance date, only sequenced from the reverse end.

Longevity

No matter how you envision your retirement, it's important to consider how long this life stage might last. While it's good news that retirees are living longer, healthier and more active lives than in the past, longer life expectancies may mean greater risk of outliving your savings. Did you know that one in three 65-year-olds will live to age 901 and one in seven 65-year-olds will live to the age 952? Also, only 6 in 10 Americans are confident their savings and investments will last at least until age 902.

1Retirement Information for Medicare Beneficiaries, Social Security Administration, 2024.

2The Facts of Life and Annuities, LIMRA, 2023.

At MassMutual Ascend, we are committed to going above and beyond - so when it comes to your financial future, the impossible feels possible.

If you have concerns about any of the risks outlined, it might be time to consider incorporating an annuity in your financial plan. 69% of annuity owners are confident that their savings and investments won't run out if they live to age 901. Talk to your financial professional today about how an annuity can bring you peace of mind as you plan for a secure financial future.

To learn more about these market risks, read our full flier here!

12020 Consumer Survey, Secure Retirement Institute.

ICC24-P1850824NW , ICC24-P1841724NW, ICC24-P1841624NW and P1841622ID.

When you buy an annuity, you own an insurance contract. You are not buying shares of any stock or investing in an index. Annuities are intended to be long-term investments and may not be suitable for all investors. Withdrawals from an annuity contract may have tax consequences.

MassMutual AscendSM is not an investment adviser and the information provided in this document is not investment advice. You should consult your investment professional for advice based on your personal circumstances and financial situation.

The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by MassMutual Ascend Life Insurance Company. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); MassMutual Ascend Life Insurance Company’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Products issued by MassMutual Ascend Life Insurance CompanySM (Cincinnati, Ohio), a wholly owned subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual).

This content does not apply in the state of New York.

Not a bank or credit union deposit or obligation - Not FDIC or NCUA-insured - Not insured by any federal government agency - May lose value - Not guaranteed by any bank or credit union

X6082525NW

Have questions? Get in touch with a financial professional.

If you’re interested in learning more about an annuity from MassMutual Ascend, we can connect you with a financial professional who can help.